Automating Your Financial Dealings with The help of SHE Technologies Banking Integration Services in Pakistan

As businesses continue to evolve in the technological era, the demand for seamless integration between banking systems and other financial processes has become increasingly crucial. SHE Technologies has been at the forefront of providing advanced banking integration services that cater to the complex needs of modern businesses. Through their innovative solutions, SHE Technologies has revolutionized the way organizations manage their financial operations, offering a comprehensive suite of services designed to streamline and optimize banking integration.

SHE Technologies banking integration services encompass a wide range of features that are customized to meet the diverse requirements of businesses across various industries. From real-time transaction monitoring to secure data exchange, their services are designed to enhance operational efficiency and provide a competitive advantage in the market. By leveraging advanced technologies and industry best practices, SHE Technologies has positioned itself as a trusted partner for businesses seeking to elevate their financial processes through seamless banking integration.

The significance of effective banking integration cannot be overstated, especially in today's fast-paced business environment. With SHE Technologies expertise in this domain, businesses can harness the power of their banking integration services to achieve greater operational agility, improved decision-making, and enhanced customer satisfaction.

Future Trends in SHE Technologies Banking Integration

As the financial industry continues to evolve in response to technological advancements and shifting consumer behaviors, several key trends are poised to shape the future of SHE Technologies Banking Integration. Understanding these trends is essential for banks looking to stay ahead of the curve and leverage the full potential of integrated banking solutions.

Enhanced AI and Machine Learning Integration

The integration of advanced artificial intelligence (AI) and machine learning capabilities within SHE Technologies Banking Integration will enable banks to harness predictive analytics, personalized recommendations, and automated decision-making processes. By leveraging AI and machine learning, banks can unlock new levels of operational efficiency, risk management, and customer engagement, redefining the role of technology in banking operations.

Open Banking Ecosystem Integration

The evolution of open banking ecosystems will drive greater collaboration and integration opportunities for banks. SHE Technologies Banking Integration will play a pivotal role in facilitating seamless connectivity and data exchange within the open banking landscape, enabling banks to offer innovative products and services while adhering to regulatory standards and customer privacy requirements.

Blockchain and Distributed Ledger Integration

The integration of blockchain technology and distributed ledger systems within SHE Technologies Banking Integration will revolutionize transaction security, transparency, and traceability. By incorporating blockchain capabilities, banks can streamline cross-border transactions, mitigate fraud risks, and enhance the integrity of financial data, paving the way for a more secure and efficient banking ecosystem.

Real-Time Payments and Instant Settlement Integration

The demand for real-time payments and instant settlement capabilities continues to grow, driven by consumer expectations for immediate transactions and fund availability. SHE Technologies Banking Integration will evolve to support seamless integration with real-time payment networks, enabling banks to offer instantaneous payment solutions while ensuring compliance with regulatory frameworks and risk management protocols.

API-First Integration Architecture

The API-first integration architecture within SHE Technologies Banking Integration will enable banks to embrace a modular, interoperable, and extensible framework for integrating new services, applications, and data sources. By embracing these future trends, banks can position themselves as pioneers in leveraging SHE Technologies Banking Integration to drive innovation, customer value, and operational excellence in the digital banking landscape.

Understanding the Features of SHE Technologies Banking Integration Services

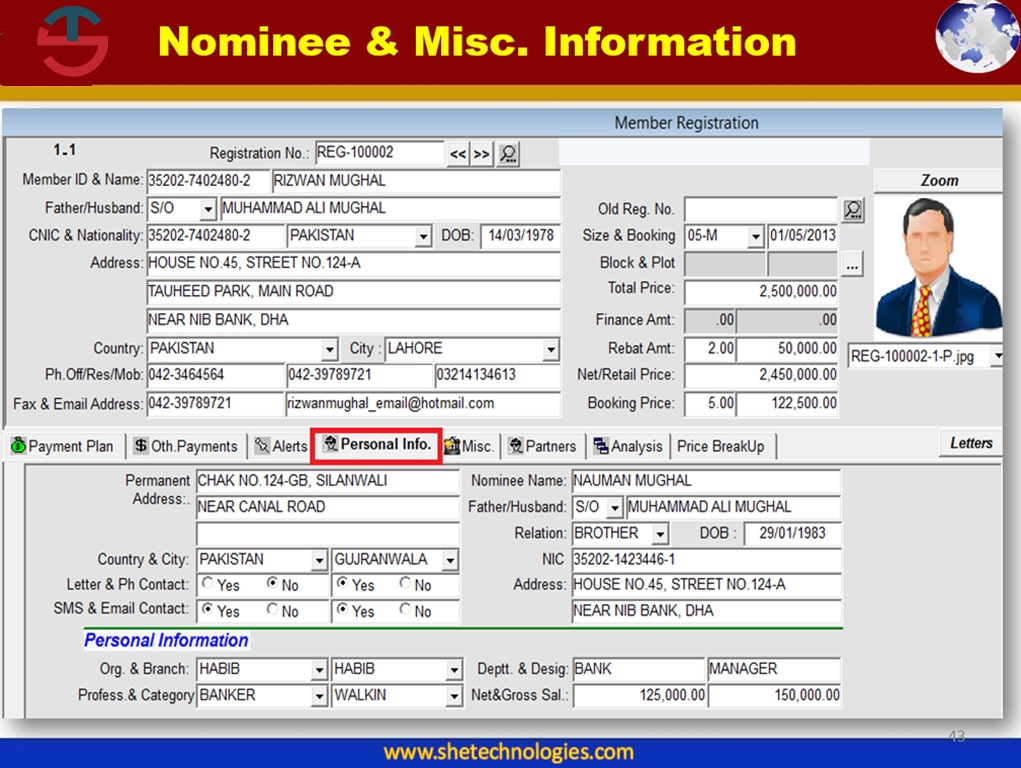

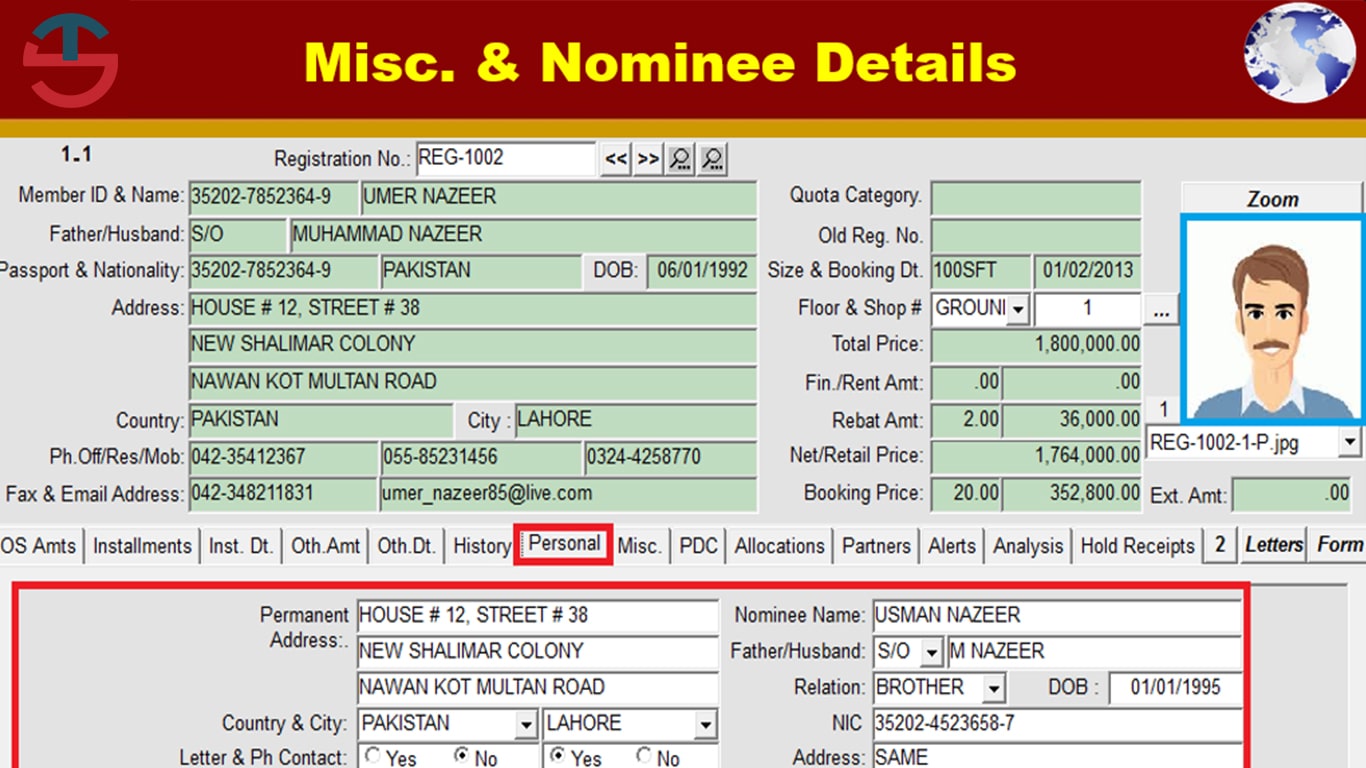

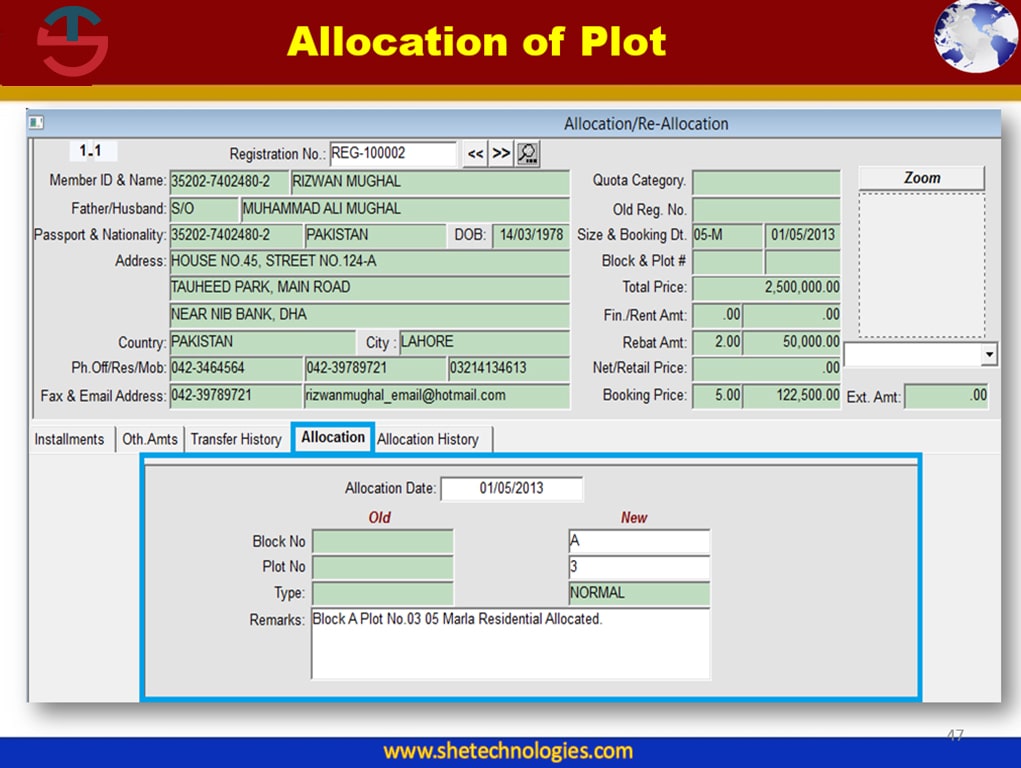

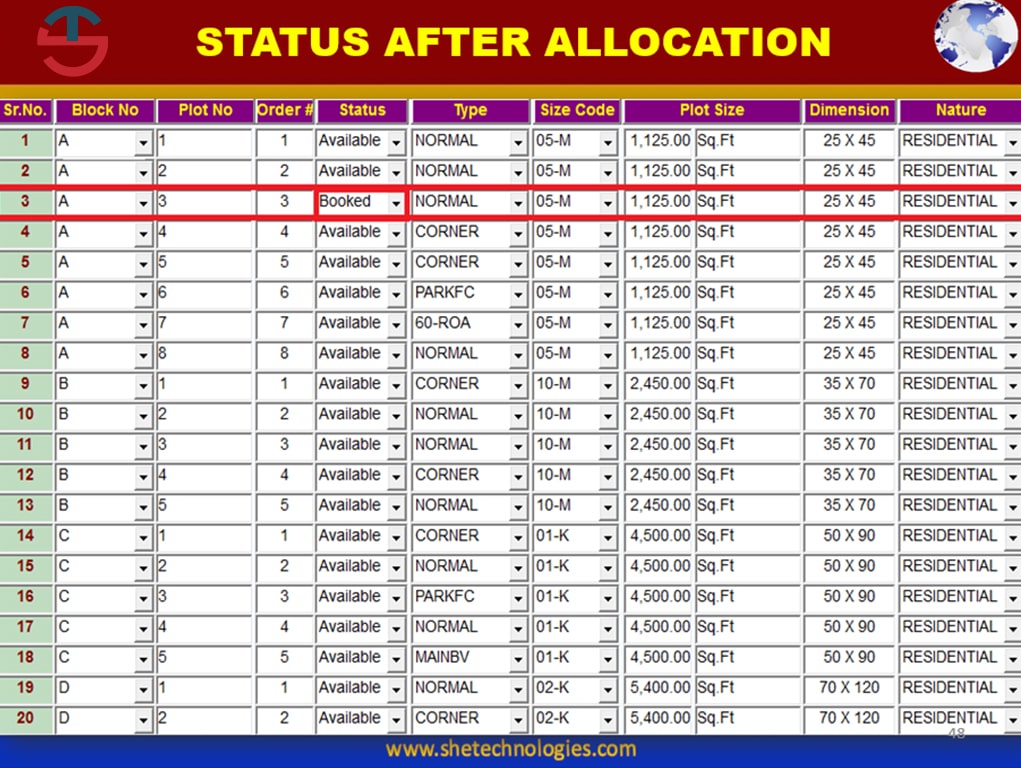

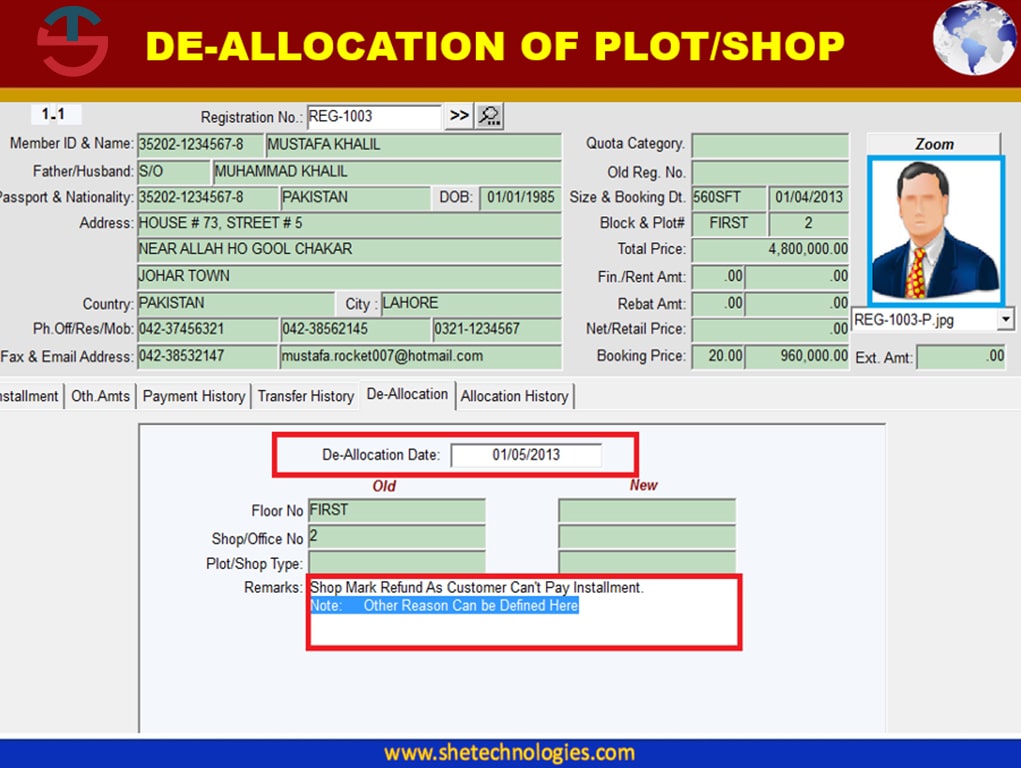

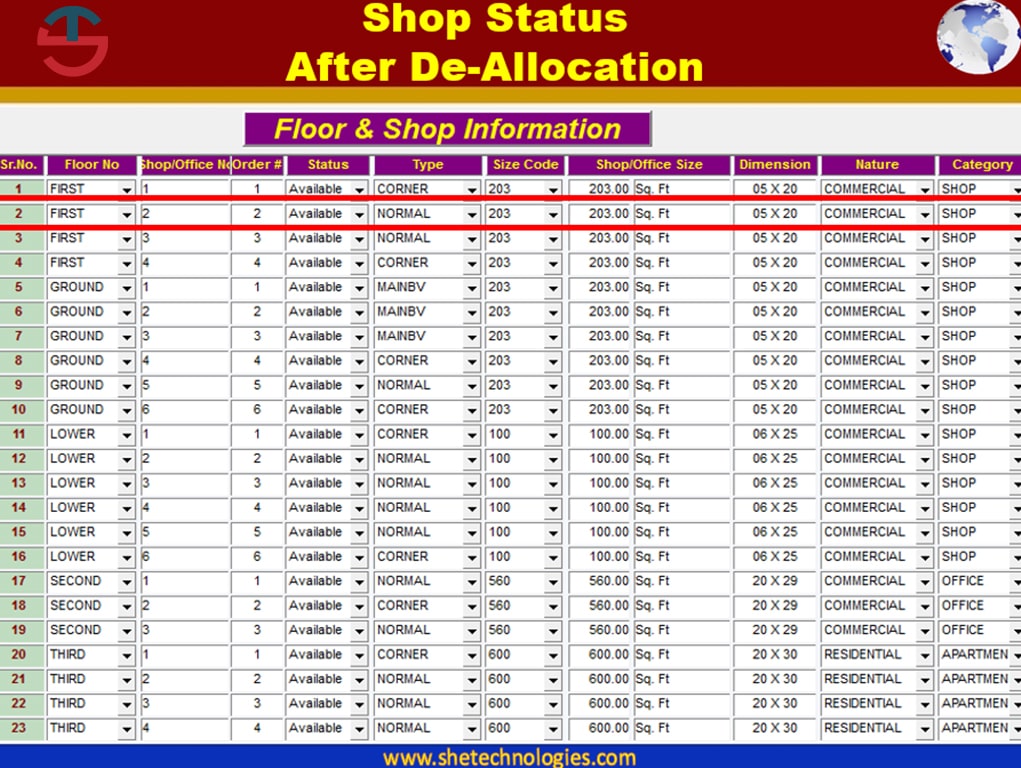

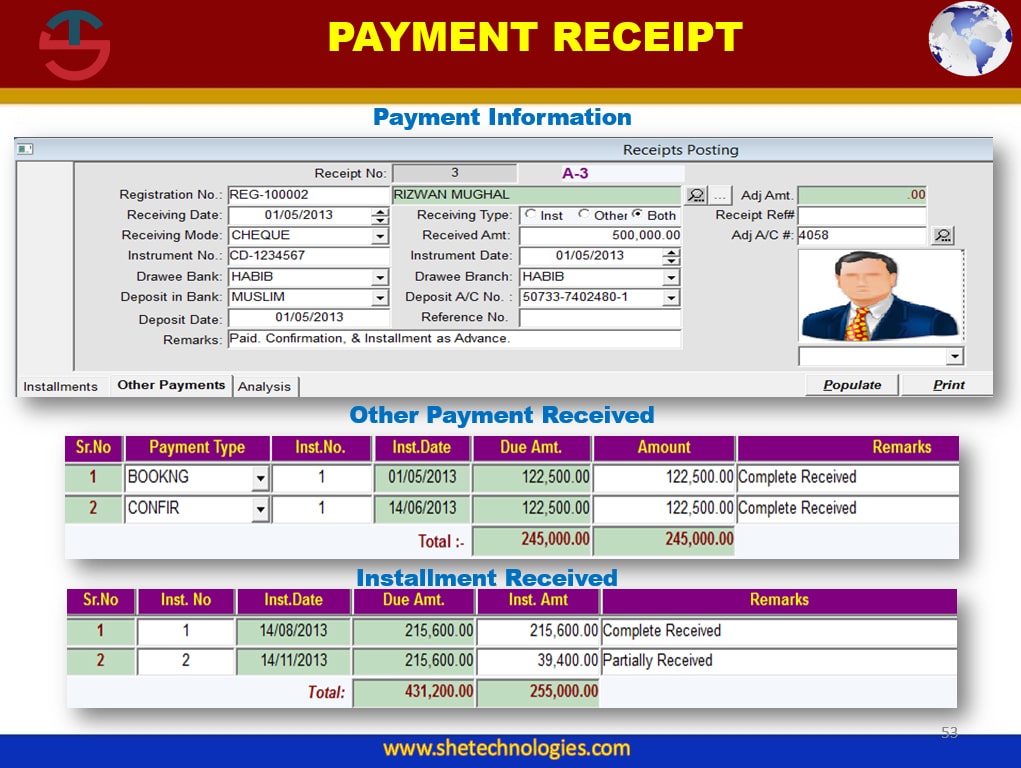

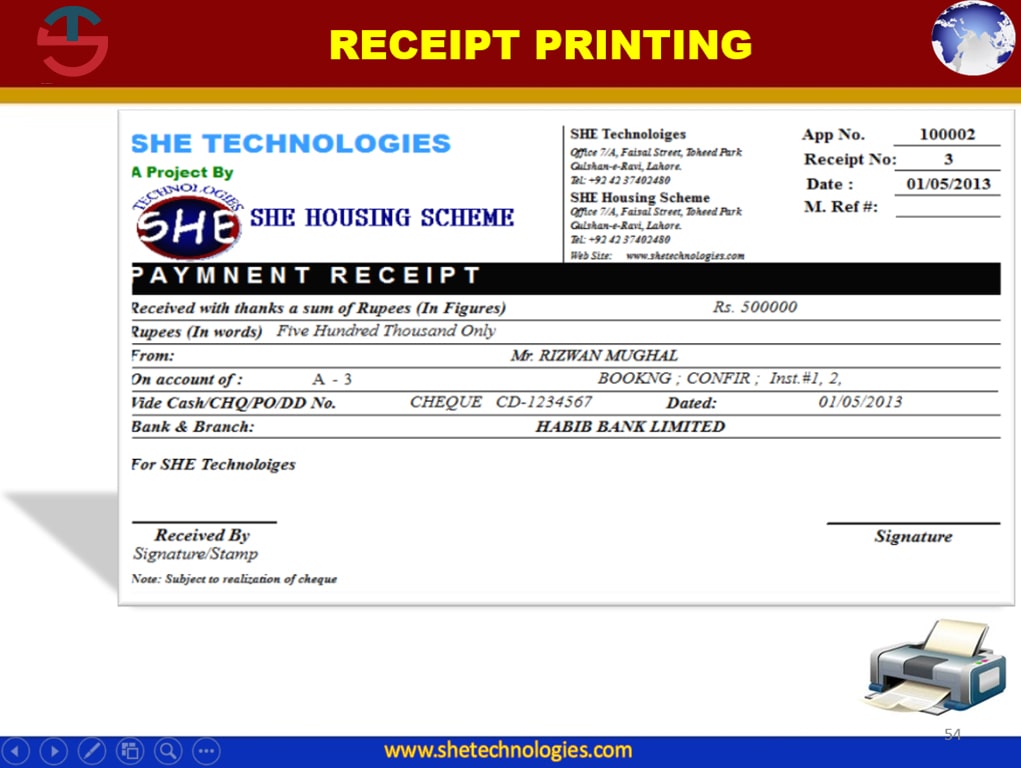

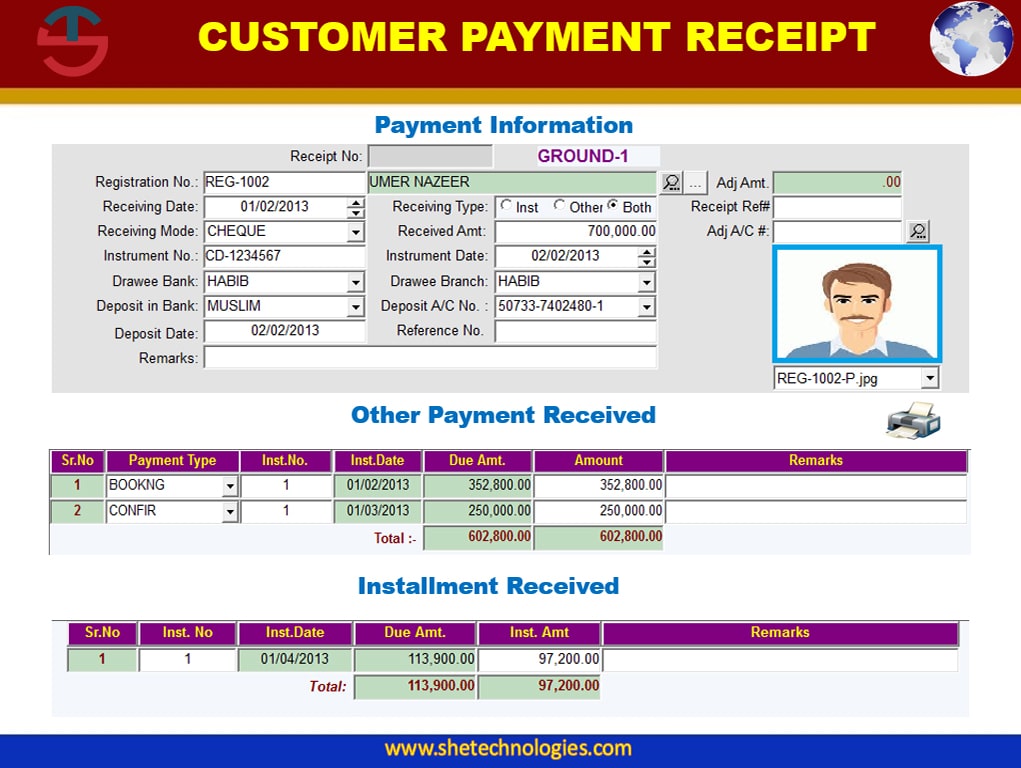

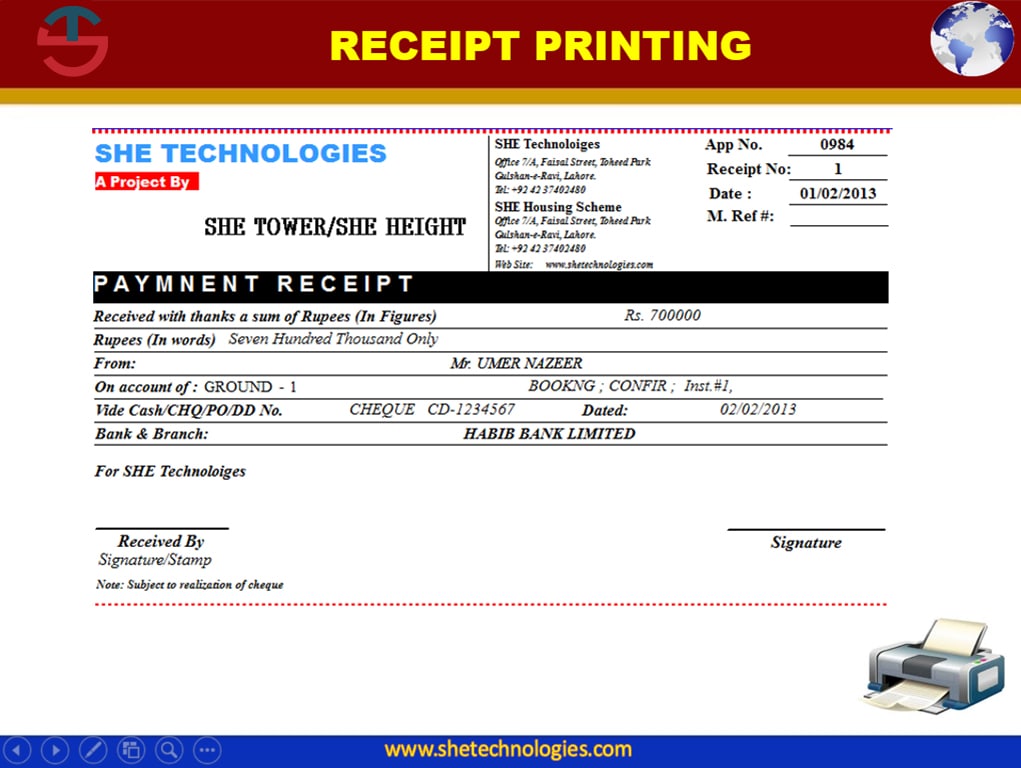

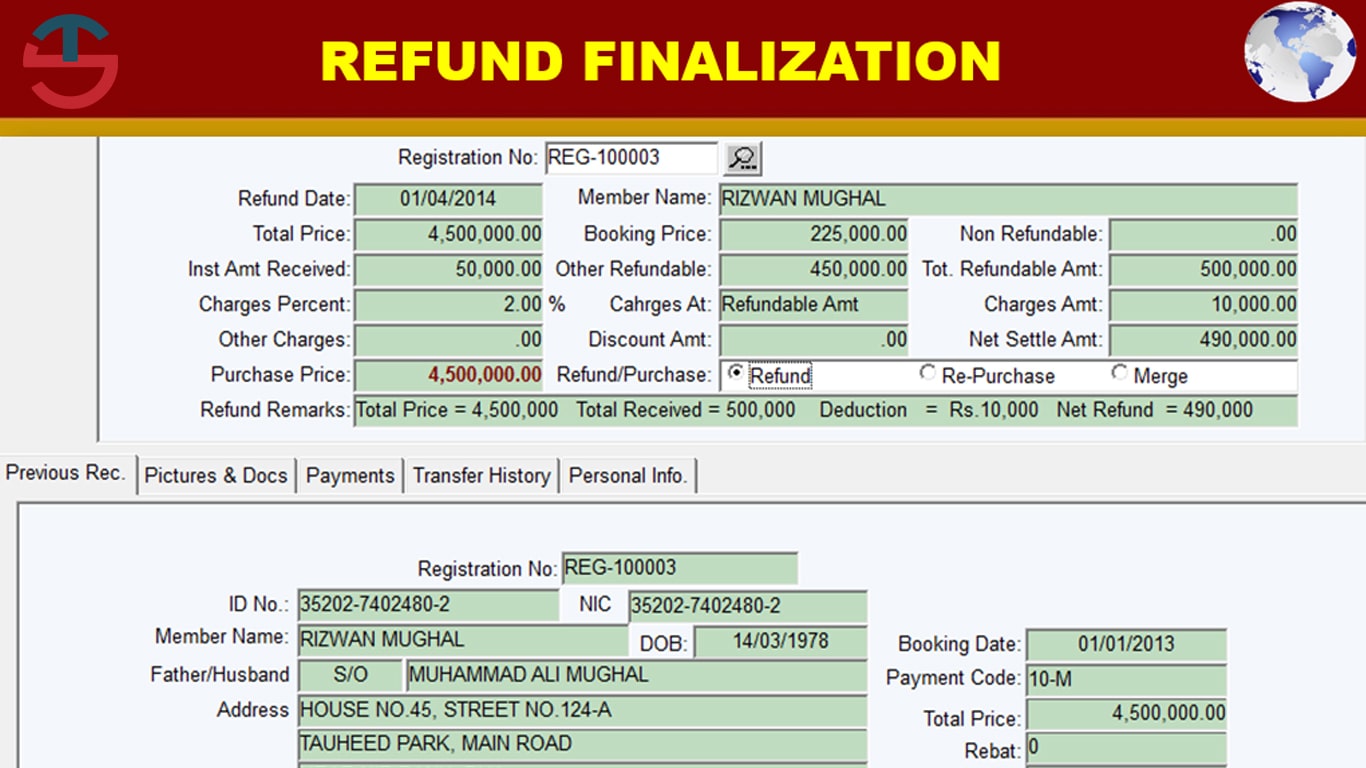

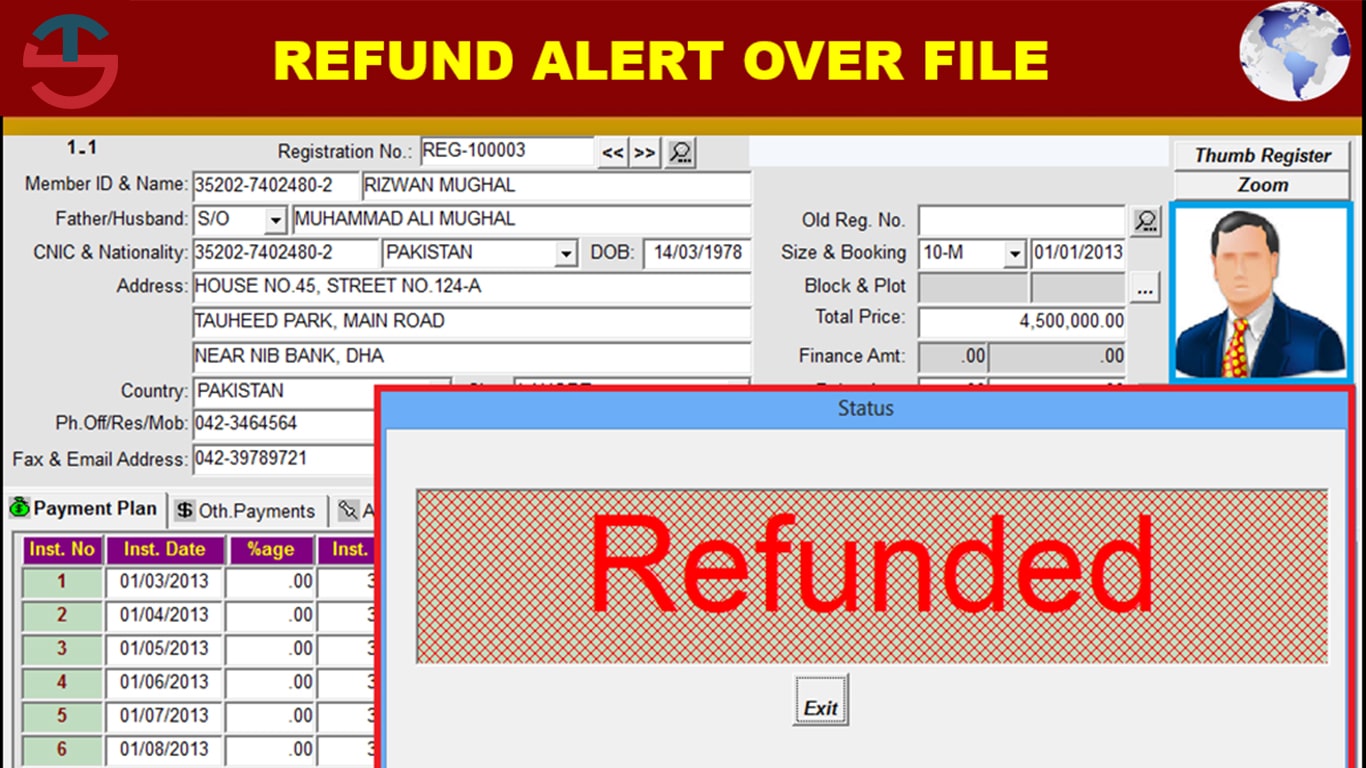

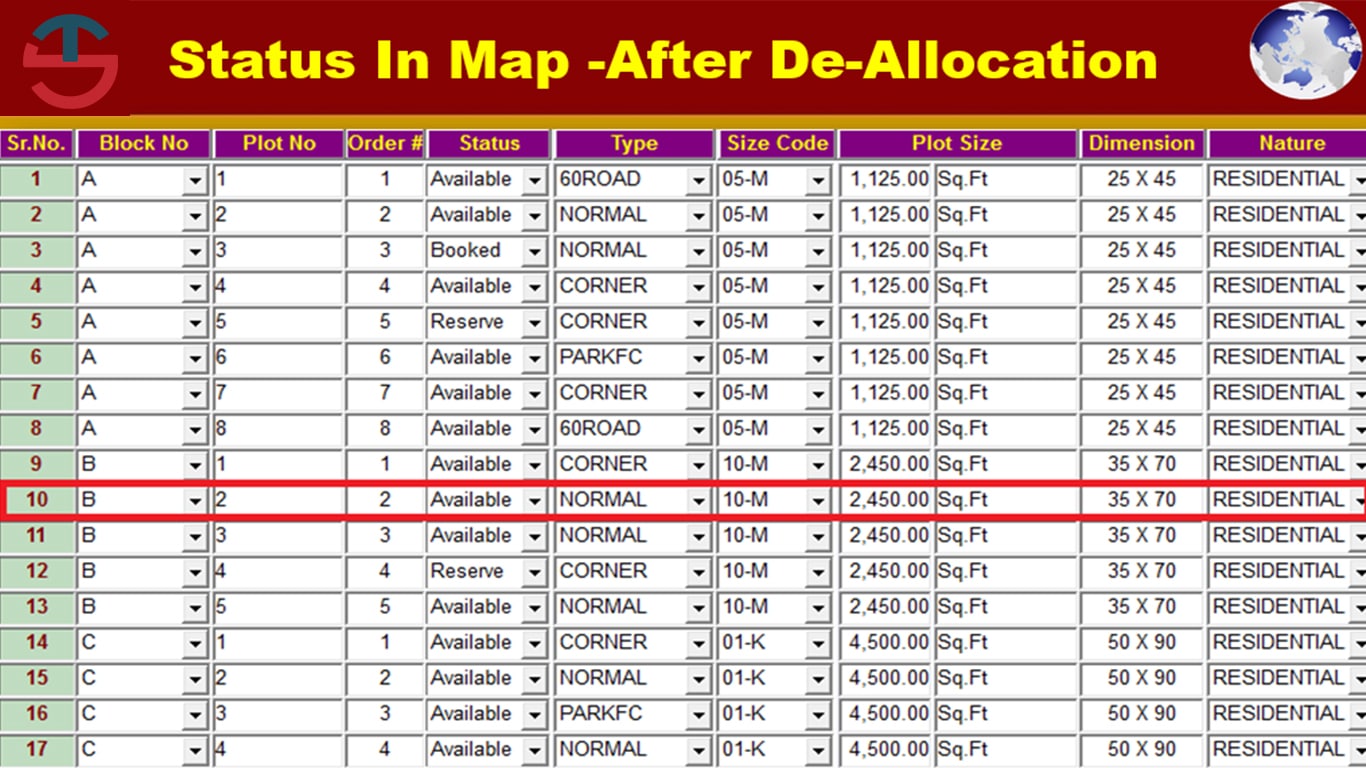

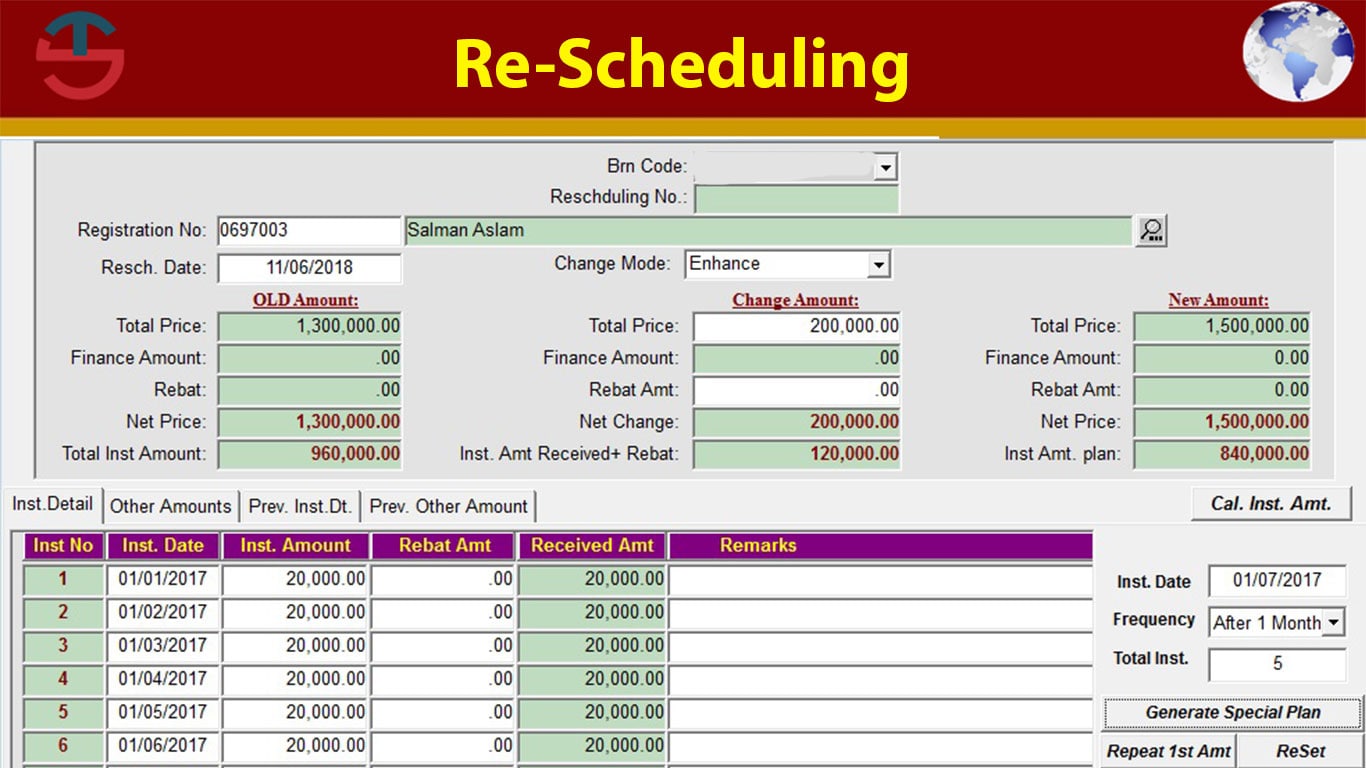

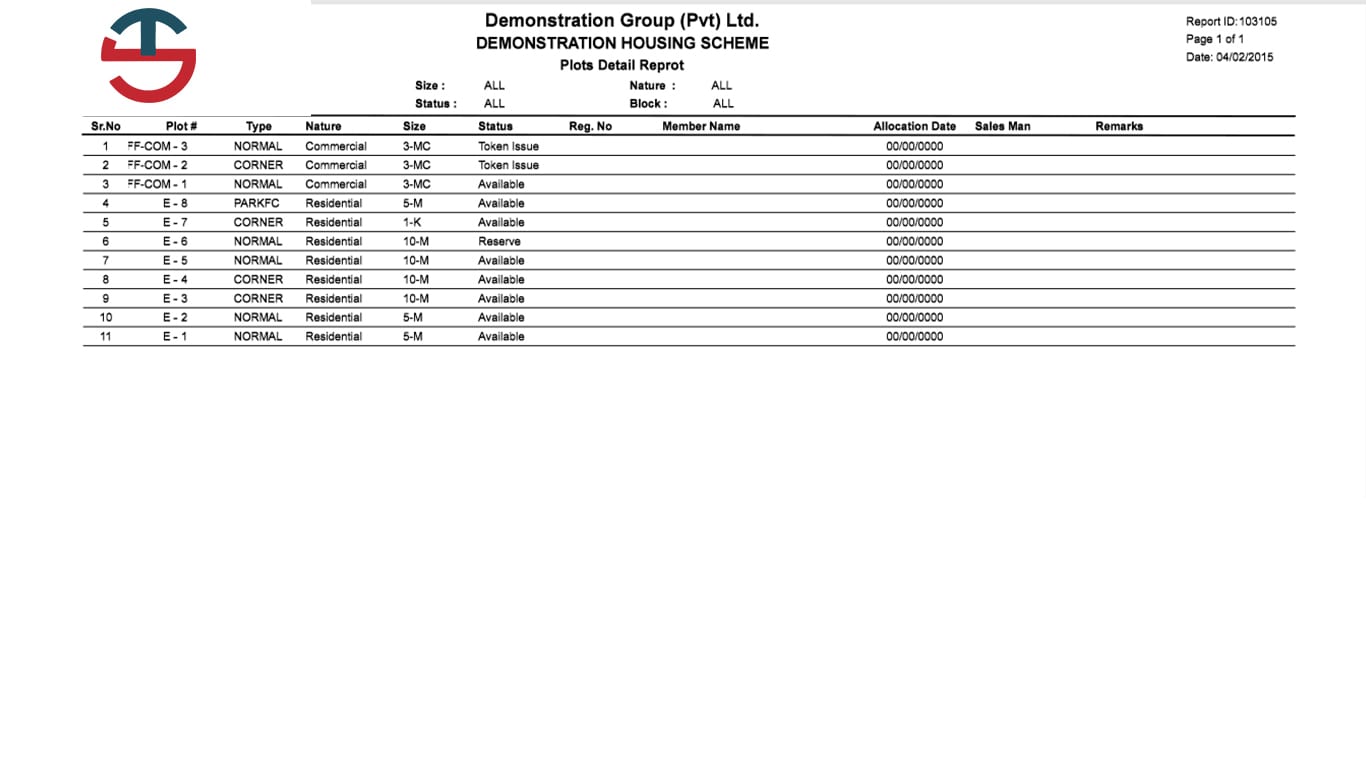

SHE Technologies banking integration services are built upon a foundation of advanced features that are designed to address the multifaceted requirements of businesses operating in the financial landscape. One of the key features of their services is the seamless connectivity with multiple banking systems, allowing businesses to consolidate their financial data and gain a unified view of their transactions and accounts. This level of integration not only enhances visibility and control but also enables businesses to make informed decisions based on real-time insights.

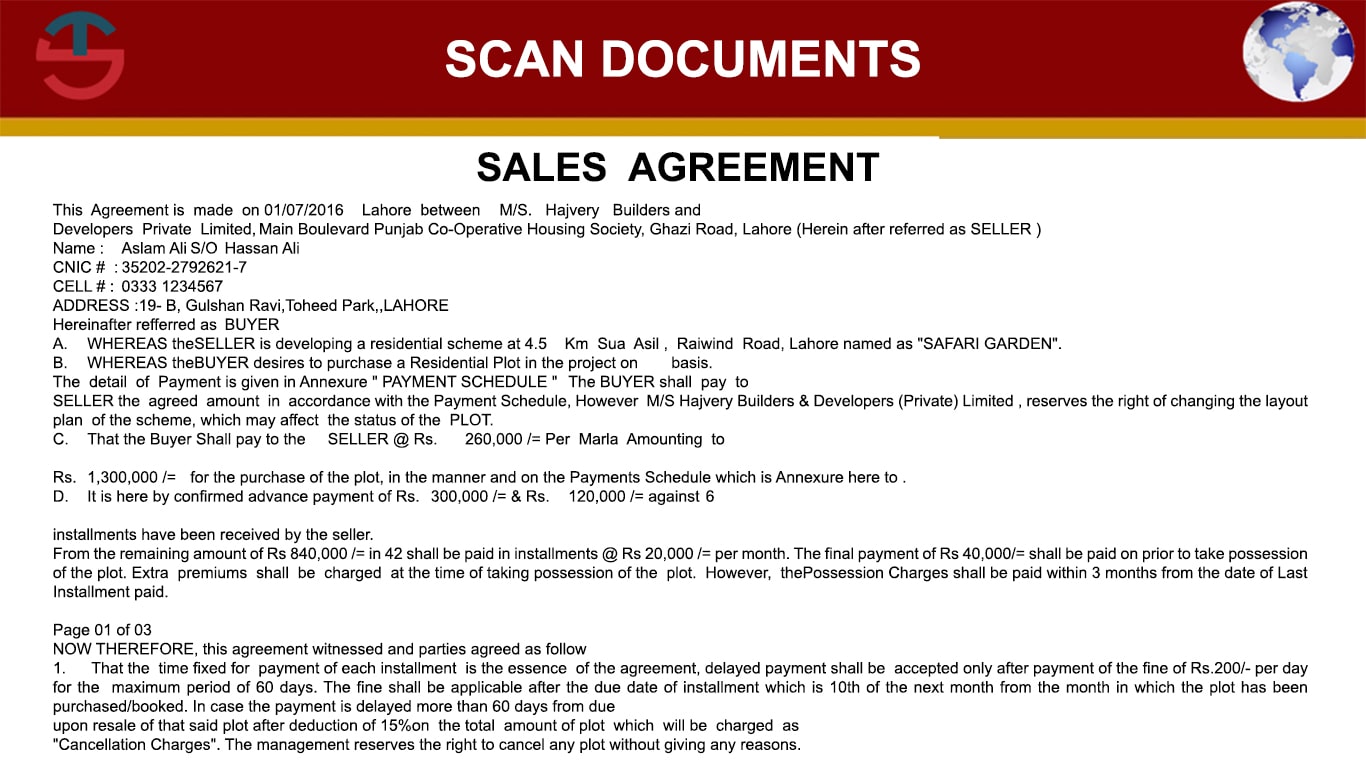

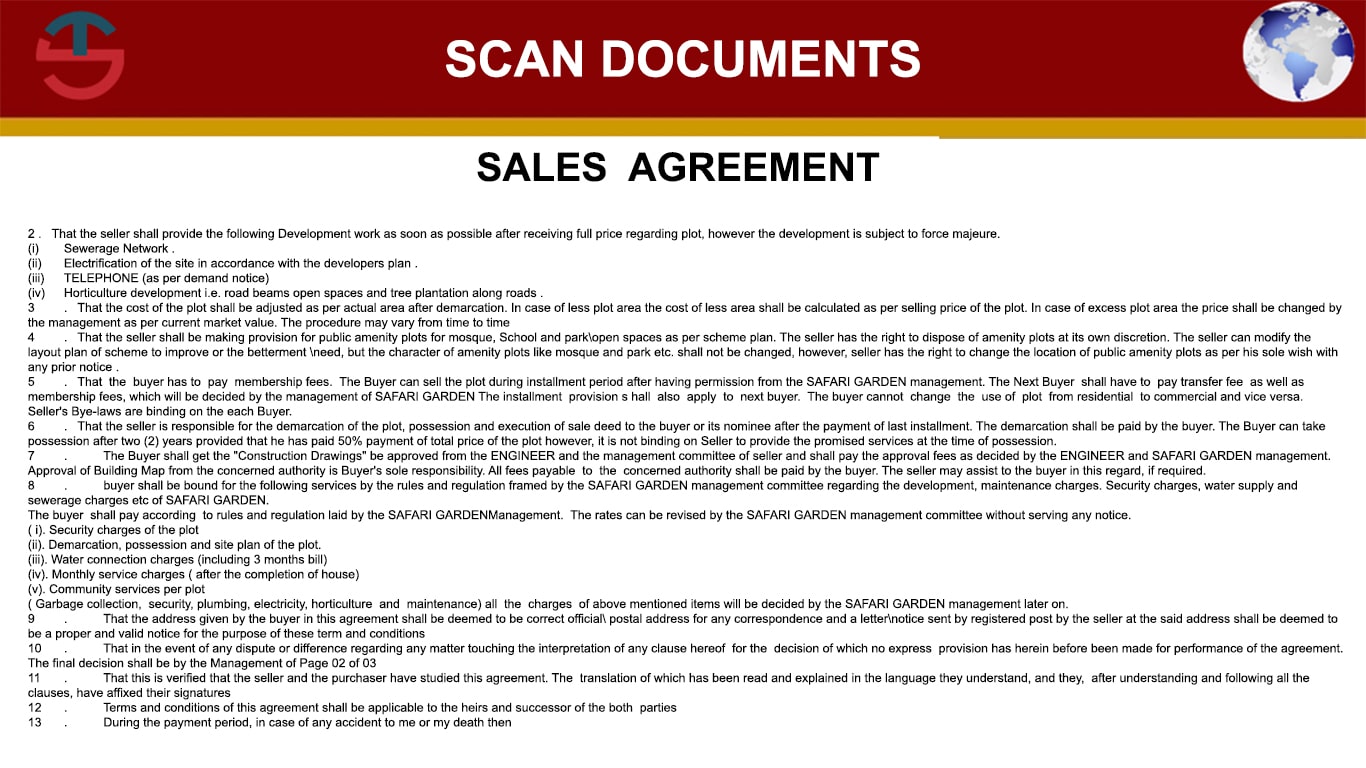

Furthermore, SHE Technologies banking integration services offer robust security measures to secure sensitive financial information and ensure compliance with industry regulations. Through the implementation of encryption protocols, secure authentication mechanisms, and data validation processes, businesses can trust that their financial data is protected from unauthorized access and potential threats. This aspect of the services instills confidence in businesses to embrace digital transformation without compromising the security of their financial operations.

Another notable feature of SHE Technologies banking integration services is their scalability and flexibility. Whether businesses are looking to expand their operations, enter new markets, or adapt to changing regulatory requirements, the services are equipped to accommodate evolving needs seamlessly. This scalability empowers businesses to future-proof their financial processes and adapt to dynamic market conditions, thereby staying ahead of the curve in an increasingly competitive landscape.

Exploring the Benefits of SHE Technologies Banking Integration Services

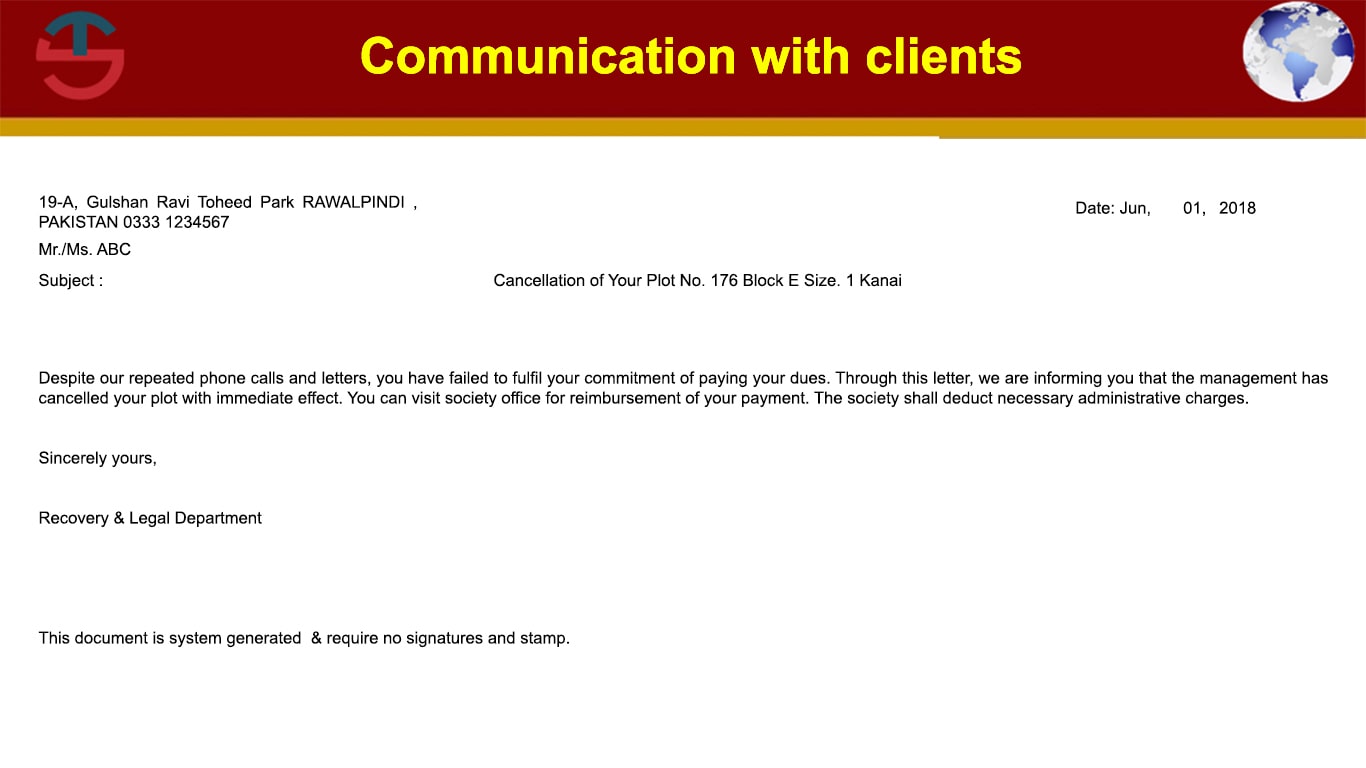

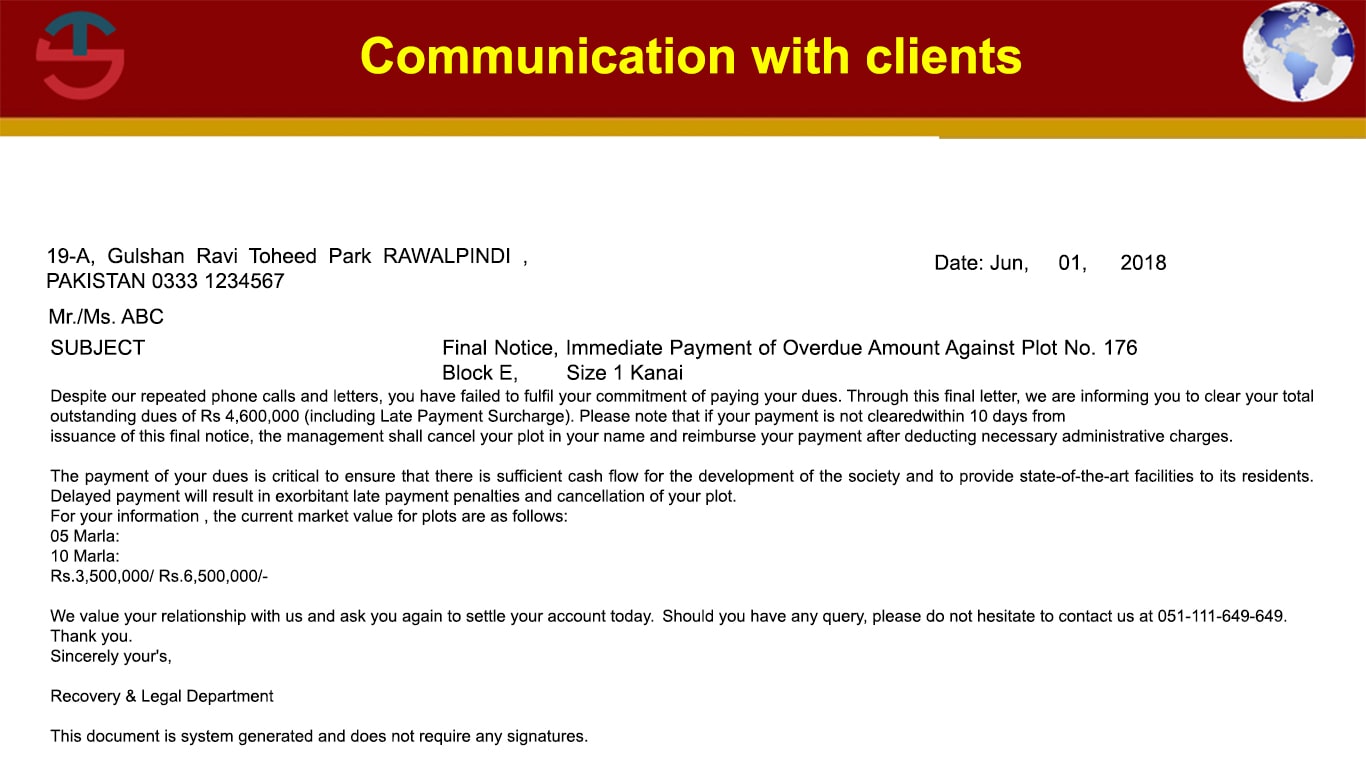

SHE Technologies banking integration services provide a countless benefits that directly impact the efficiency, productivity, and profitability of businesses. One of the primary benefits is the reduction of manual efforts and errors in managing financial transactions. By automating the integration of banking systems with other operational processes, businesses can minimize the risk of human error and free up valuable resources to focus on strategic initiatives.

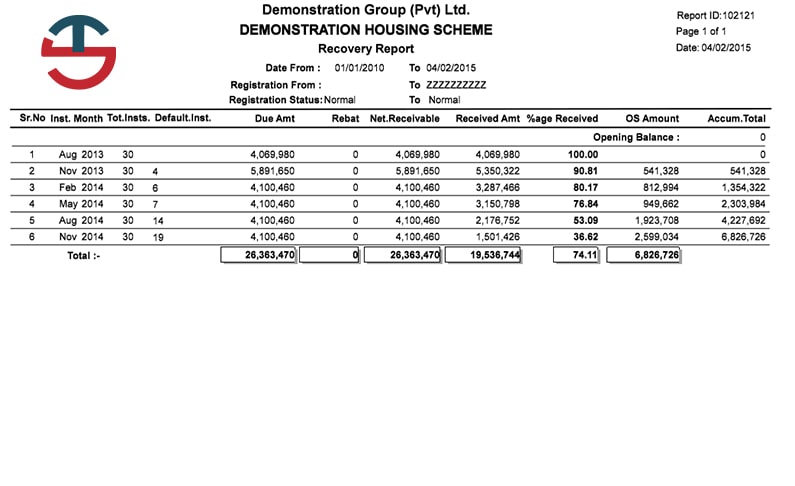

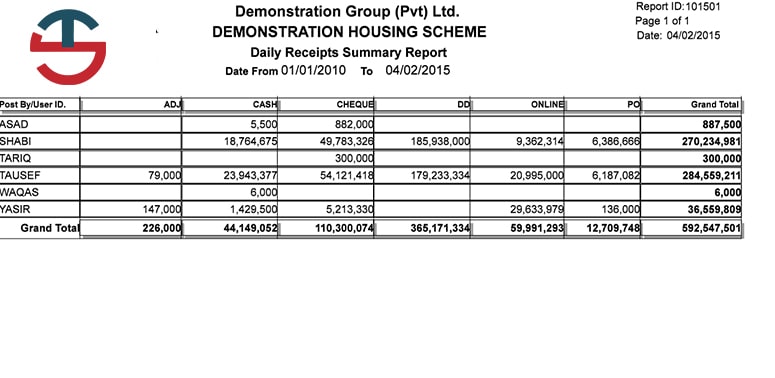

Moreover, SHE Technologies banking integration services contribute to enhanced operational visibility, enabling businesses to gain comprehensive insights into their financial performance and trends. With real-time access to transaction data, account balances, and cash flows, organizations can make data-driven decisions with confidence, leading to improved financial planning, risk management, and resource allocation.

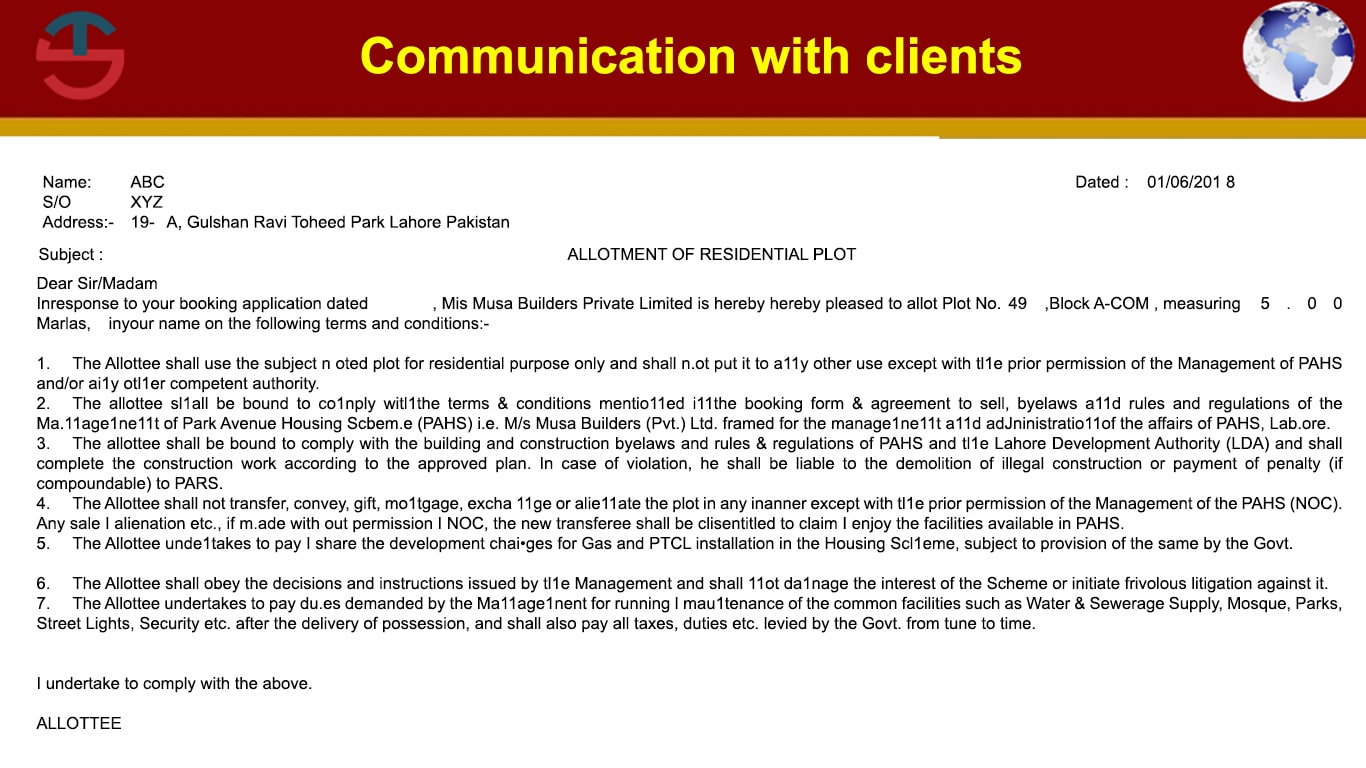

Additionally, the services offered by SHE Technologies facilitate seamless collaboration and communication across different departments within an organization. Through integrated banking systems, finance, sales, procurement, and other departments can share relevant financial data and collaborate on cross-functional initiatives, promoting greater synergy and alignment across the business.

Training and Support for SHE Technologies Banking Integration

The successful implementation and utilization of SHE Technologies Banking Integration hinge on comprehensive training and support initiatives that empower bank staff to leverage the integrated framework effectively. Investing in training programs and support mechanisms is paramount to ensuring a smooth transition, adoption, and optimization of the integration solution.